Product

Product

News

When Trump aimed his tariff cannon at China and the tax rate soared to a magical 145% (far exceeding the 20% before the Great Depression in 1930), the White House no longer wielded a trade baton, but a butcher's knife that tore apart the global order! What impact will the tax rate that imposes the death penalty on Sino US trade have on the magnetic component industry?

This round of tariff war should come to a temporary end.

Currently, the United States has tariffs of 145% on China, 20% on the European Union, and 10% on other countries.

China imposes a comprehensive tax rate of over 140% on American goods.

At the same time, China also stated in the announcement that, given the current tariff level, there is no market acceptance possibility for US goods exported to China. If the US continues to impose tariffs on Chinese goods exported to the US in the future, China will ignore it.

Image source: People's Daily

The tariff war initiated by US President Hoover in 1930 resulted in an average tax increase of only 20%, ultimately leading to a 65% drop in global trade volume and triggering an economic crisis in the United States and the world. From any perspective, this round of tariff confrontation has reached a magical level.

From an industrial logic perspective, a 20% tariff is sufficient to cut off the feasibility of most direct trade - companies with profit margins exceeding 50% are rare, and higher tariffs have essentially become a tool of political game.

This tariff game presents two major characteristics: first, the "maximum pressure" far exceeds historical levels (145% vs 20% in 1930); The second is the significant intention of targeted containment, with only the European Union and China excluded from the list of suspended tax increases.

Which products will be affected

According to the latest data in 2024, the top ten goods imported by China from the United States are mainly related to the electronics manufacturing industry, including the following products:

Industrial and high-tech products (accounting for approximately 25%)

Semiconductors and integrated circuits: High end chips still rely on imports from the United States, with a total value of 83.877 billion yuan (approximately 11.8 billion US dollars) in 2024, accounting for 7.21% of China's imports from the United States.

Precision instruments: including medical equipment (such as MRI, CT machines), semiconductor manufacturing equipment, etc., with a total amount of 31.946 billion yuan (approximately 4.5 billion US dollars).

Automotive parts: The United States is the largest source of imported automotive parts from China, with a value of 18.9 billion US dollars, especially for new energy vehicle supply chains that rely on American technology.

Aerospace products

Civil aircraft and components: Despite a decrease in Boeing orders, the stock market still relies on US parts maintenance, with turbine engines and other products having a 53.2% dependence on US imports.

Medical and Pharmaceutical

High end medical equipment: Core components such as mass spectrometers and gene sequencers account for 34% of China's imports.

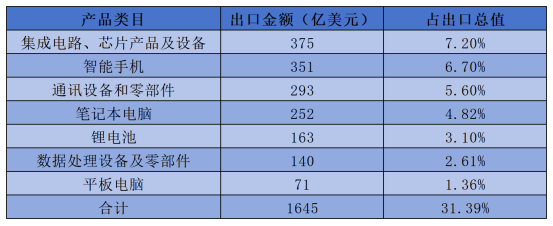

After analyzing the import structure, it is necessary to simultaneously pay attention to the core categories of China's exports to the United States. Compared to the technological dependence on imports, China's exports to the United States exhibit distinct industrial chain characteristics.

According to 2024 data, mechanical and electrical products are the "main force" of China's exports to the United States, accounting for 41.6% of the total export value, including automatic data processing equipment and its components, mobile phones and related equipment.

Image source: Snowball

However, on April 12th, the US government released a list of "exempt equivalent tariffs" for all countries around the world, including Chinese goods such as automatic data processors, computers, communication equipment, displays and modules, semiconductors, etc.

List of goods partially exempted from equivalent tariffs

The total amount of products in the above table alone has reached 164.5 billion US dollars, accounting for over 31% of exports to the United States in 2024.

According to data compiled by relevant media, the category of exempted products accounts for as much as 22% of all goods exported from China to the United States, and almost all of them are high-tech products, accounting for over 40% of the total export value to the United States in 2024.

Upon investigation, many of these products are directly manufactured in China by American technology companies and sold to the United States, which has strong internal opposition.

The uncertainty and risk of going out to sea are greater

The direct impact of this round of tariffs on the magnetic components industry is limited, but the transmission effect of the industrial chain is significant.

In the past two years, there has been a lot of noise about going abroad, and the magnetic component industry is no exception. A group of companies have just established manufacturing bases in Southeast Asian countries.

A few days ago, we were still discussing that the US policy of equal treatment of tariffs would put magnetic component companies that have just set up factories overseas in an awkward situation.

However, based on the current situation, there has been a 90 day easing period and partial exemptions from equivalent tariffs have been announced. The US government has also revealed the possibility of negotiations with some countries such as Vietnam.

But there are still many uncertainties, such as whether the negotiations can truly be reached, which countries and regions can achieve the negotiations, and what the final outcome of the negotiations will be.

For magnetic component companies that have already gone global, if the negotiation results are not within expectations, they may face a significant increase in costs;

For magnetic component companies that want to go global, the swing of US policies will make it more difficult to choose their future goals.

conclusion

Overall, this round of tariff war has evolved from an economic game to a strategic confrontation:

Short term: A benchmark tariff of 10% will squeeze the profit margins of magnetic component companies, forcing production capacity on the brink of cost to relocate;

Long term: If the 145% tariff continues, the risk of decoupling the technology and supply chains between China and the United States will accelerate the restructuring of the global industrial chain.

Historical experience has shown (such as the 1930 tariff war) that high tariffs will eventually backfire on the economy of the initiating country, but the current game is far beyond pure economic logic, and magnetic component companies need to prepare for the normalization of "politicized trade".

*Disclaimer: All statements and opinions regarding original and reprinted articles are neutral, and the articles are only for readers to learn and communicate. The copyright of articles, images, etc. belongs to the original author. If there is any infringement, please contact us for deletion. This article is reprinted from (Big Bit Electronic Transformers and Inductors)